U.S. and global stocks climbed last week as easing trade tensions and better-than-expected earnings boosted investor confidence. The S&P 500 logged its longest winning streak of the year, helped by strong tech results and signs that a major trade deal may be near. While U.S. GDP showed a surprise contraction, consumer spending held up and job data was mostly positive, pushing Treasury yields higher. European markets rallied on improved growth, Japan gained on dovish central bank signals, and China hinted at re-engaging in trade talks despite weak economic data.

Markets Rally on Easing Trade Tensions and Solid Earnings

U.S. stocks had a strong week, with the S&P 500 posting its second straight weekly gain—the first time since January—and logging nine consecutive positive sessions. The Nasdaq jumped 3.4%, lifted by upbeat earnings from big tech, while small- and mid-cap stocks extended their winning streaks to four weeks.

Early optimism came from signs of progress on trade, including Trump easing some auto tariffs and officials hinting a major deal was close. As the week went on, investor focus shifted to earnings. Around 40% of the S&P’s market cap reported, including four of the “Magnificent Seven.” While many companies flagged uncertainty in forward guidance, investors remained upbeat, betting firms could ride out weaker growth and ongoing tariff noise.

Jobs Picture Mixed but Mostly Encouraging

Economic data was a mixed bag. Job openings slipped to 7.2 million in March—the lowest since September—and ADP’s private payrolls report disappointed. But Friday’s official jobs data came in better than expected, with 177,000 new jobs added in April and wages up modestly. That boosted market sentiment to close out the week.

U.S. Economy Contracts, but Consumers Still Spending

The BEA said GDP shrank 0.3% in Q1—marking the first contraction since 2022—mainly due to a surge in imports, softer consumer spending, and lower government outlays. That said, inflation stayed flat in March, and consumer spending actually rose 0.7%, suggesting the economy remained fairly resilient heading into Q2.

Treasury Yields Rise After Jobs Surprise

Bond yields dipped early in the week but rose Friday on the strong jobs report. Munis rallied on seasonals, while investment-grade corporates gave back some recent gains. High yield bonds stayed in demand despite energy sector weakness, following Saudi hints at raising oil production.

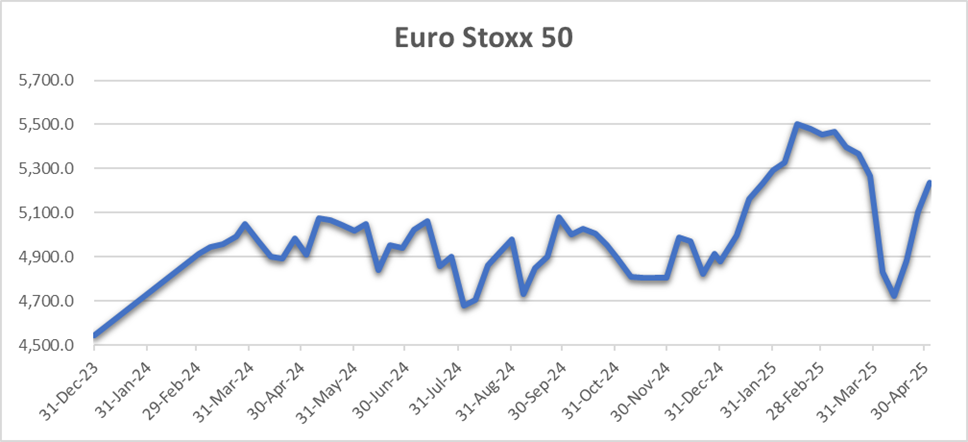

Europe: Markets Up, Growth Picks Up Too

European stocks rallied as tariff fears eased. The STOXX 600 rose 3.4%, with Germany, France, and Italy all posting solid gains. Eurozone GDP doubled quarter-over-quarter to 0.4%, beating forecasts. Inflation remained above 2%, and business confidence dipped, possibly signaling choppier months ahead.

The UK housing market cooled as a tax break expired, and business sentiment slid on tariff concerns and rising costs.

Japan: Markets Gain as BoJ Stays Dovish

Japanese stocks rose, with the Nikkei up over 3%, as the BoJ left rates unchanged and cut its growth and inflation outlooks. That pushed back expectations for the next rate hike. The yen weakened slightly, and bond yields slipped. Economic data underwhelmed, with weak PMIs, retail sales, and industrial output.

China: Weak Data, But Hints of Trade Thaw

Mainland China stocks dipped in a short trading week, while Hong Kong rose 2.4%. China signaled it may reopen trade talks with the U.S. and exempt some American imports from tariffs. But April PMIs disappointed—manufacturing fell into contraction, and services slowed. Analysts doubt China can hit its 5% growth target without more stimulus.